We have been on the road a lot the last two weeks and interest rates have become a regular topic. The renewal of operating lines has really brought this recently benign cost to the front of the line. The cost of borrowing is clearly in merchandising realm. In the deep details of how and when grain moves interest rates have become a driving force. The topic is going to cross over our focus on merchandising and risk management skills and put us in the realm of farm management as well. Sorry, I’m going to step over my bounds on this one.

Let’s set the stage with a little data. I like data, it helps settle, or at least subside some disagreements with my darling bride.

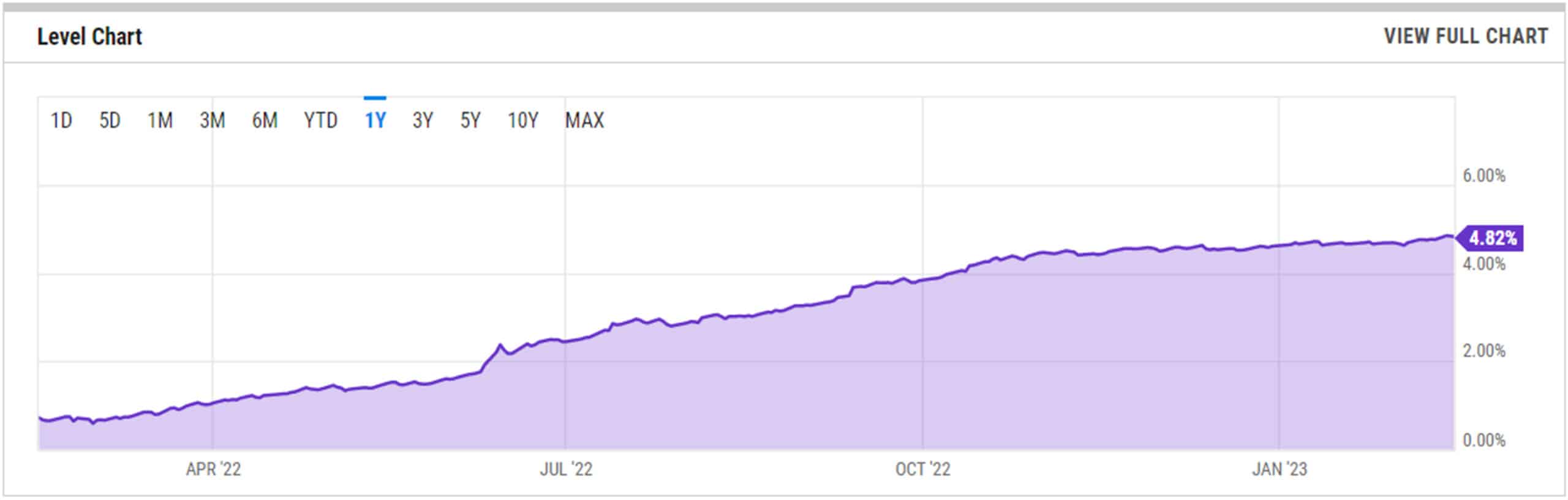

U.S. 6 month treasury: Chart 1 Feb 22-Feb 23

The US short term treasuries set the base line for “risk free” rates. In the last 12 month this rate has gone from 0.5% all the way to 4.8%. That’s a 9X increase in 12 months. Now I realize this from an absolute bottom driven by the pandemic but even I go back 3 years the 6 month treasury was 1.5%. Forget eggs going up, 60% in a year the cost of money is the real mover and shaker in inflation.

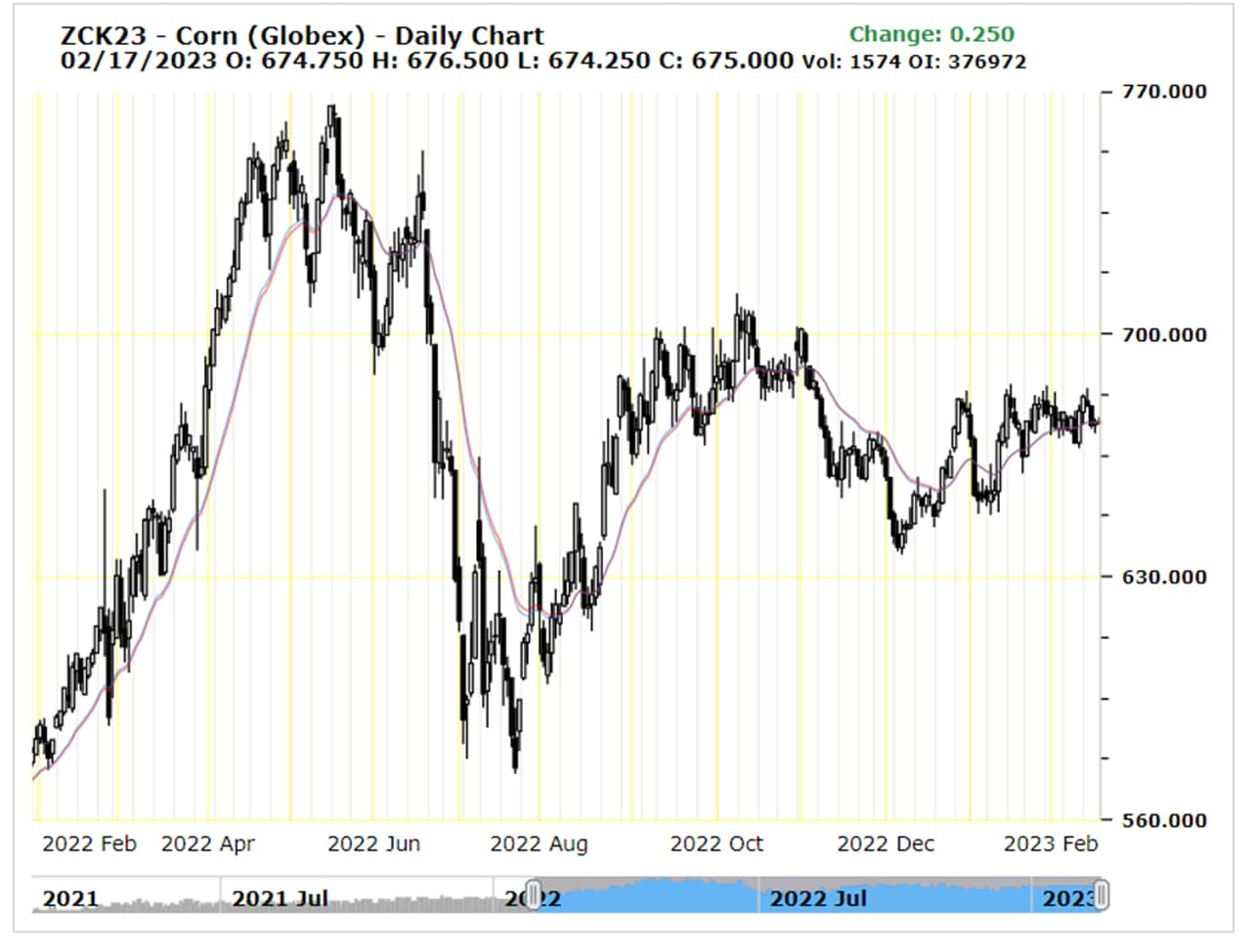

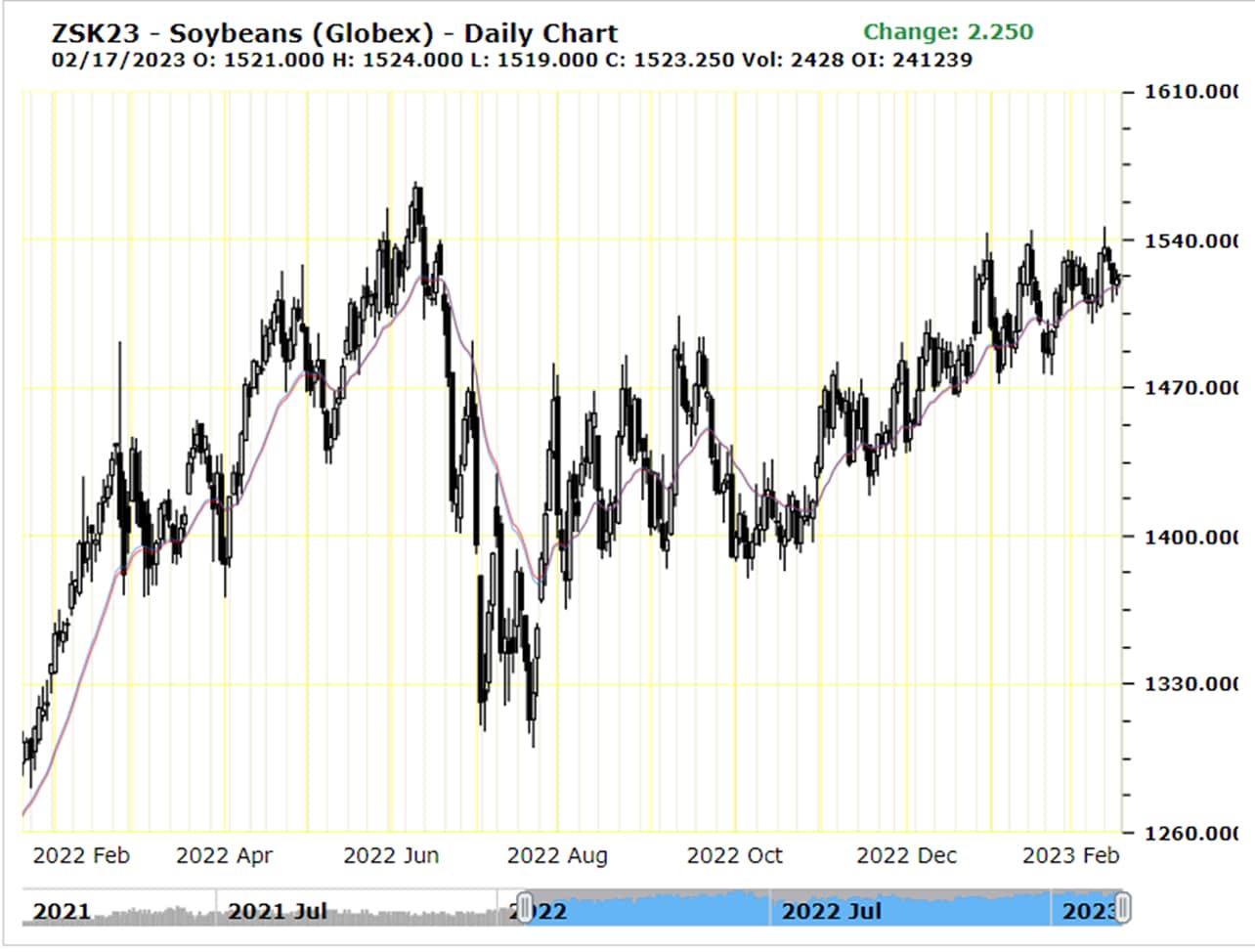

Let us add into the mix of inflation the value corn and soybeans over the same 1 year period. Corn and soybeans are hovering around the $7 and $15 market. Not to leave the wheat folks out hard red spring +$9.0 per bushel. These prices have had nice run up over the last year.

Corn CBOT

Soybeans CBOT

Now we put prices and interest rates together and apply them to your farm. The first question we get when working with a grower at the economics of storing grain on the farm is what interest rates should we use? I like to use a range. Today I wouldn’t use anything less than 4.9% annual. The reason I say this is you could always sell the grain and by 3-6 month highly liquid US treasuries. This has become very easy to do and low cost. Schwab and Vanguard, are my personal favorites and no I’m not getting an endorsement deal. Another bench mark is your operating line. You can always turn the grain into cash and pay down the operating note. Some can use the short term portion of long term debt based on making an early payment. Today we are using 5-8% in our models depending on the farm.

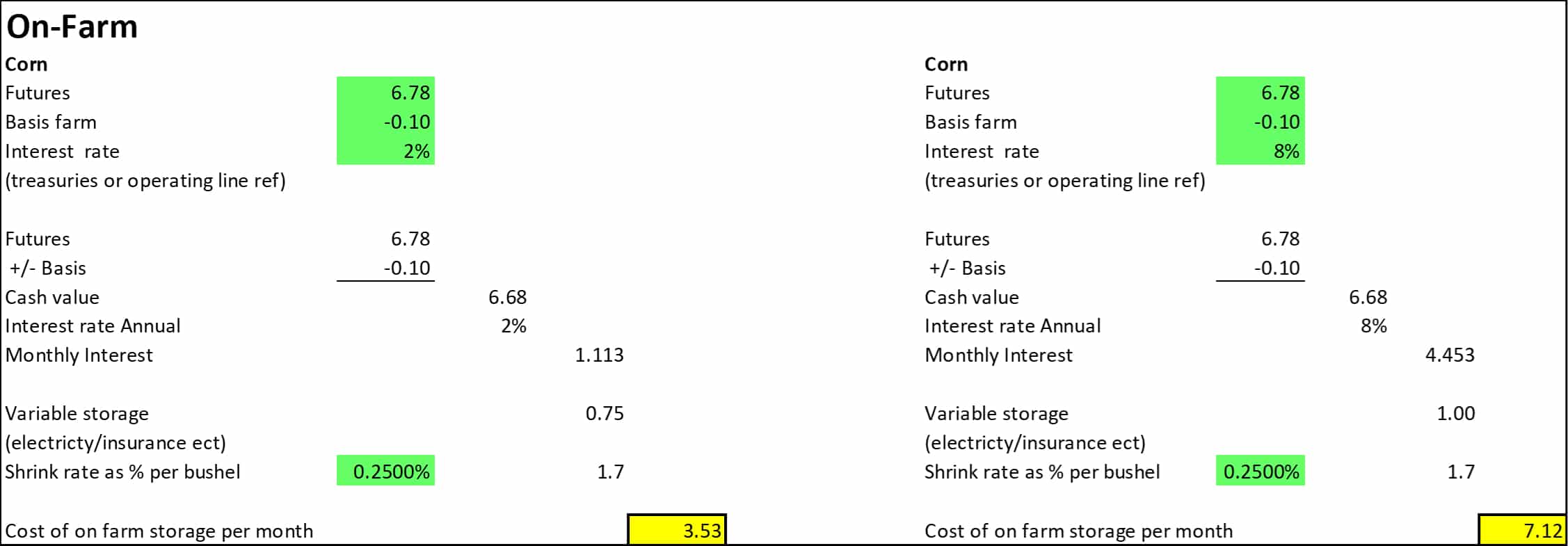

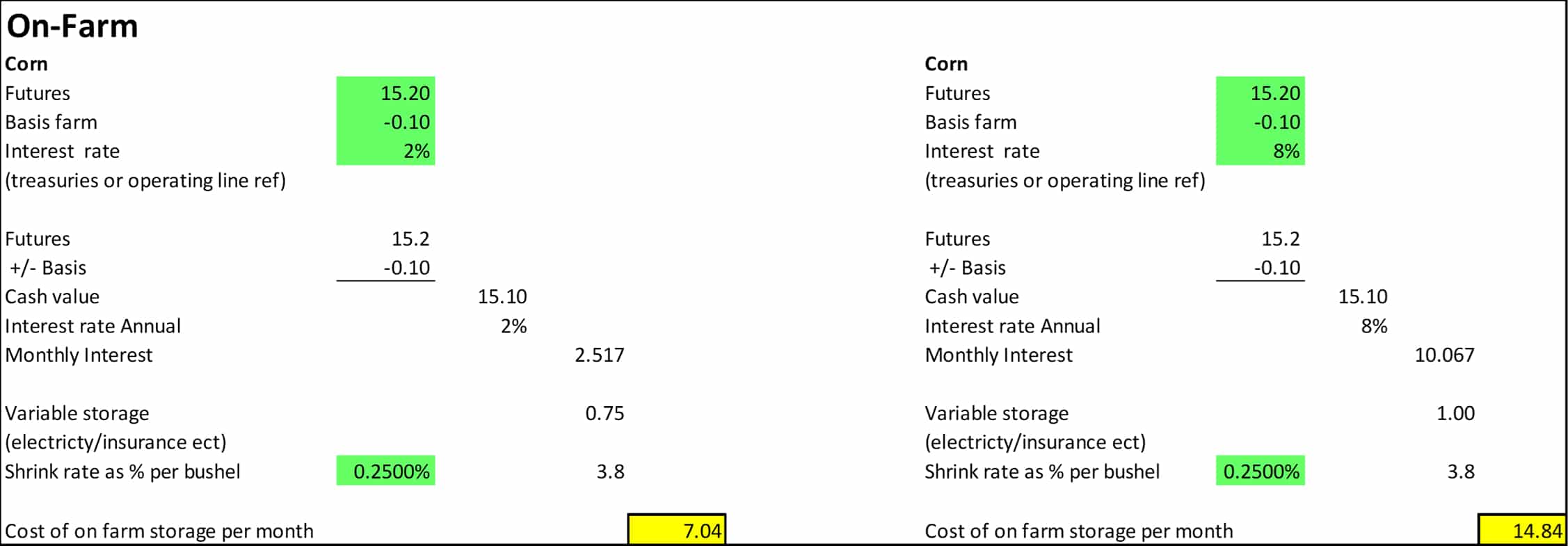

Below are some examples of the cost of on farm storage of corn. When we do this calculation we focus only on the variable cost. The fixed cost of the bin itself or the insurance of the actual bin don’t go away. We want to make sure we are earning above the variable cost of storage and hopefully covering those fixed cost plus over the course of the year.

EXAMPLE 1

Comparing a 2% interest rate to 8% rate in corn (per month in cents/bu)

You can see from the above example that the variable rate cost of holding grain ON FARM has doubled in the last year. If you don’t believe the basis is going to appreciate to cover the 7 cents per bushel in cost in this example it is time to pick a different tool out of your marketing alternative box. Now we look at the soybean example to drive home the next ah ha moment. The cost of storing beans is eye watering.

The higher interest rates are going to be pushing more grain into the market place all other things being equal. The market will create larger basis and futures carry. The US market mechanism for wider carries comes from wider CBOT spreads and more negative basis. There are many factors that come into play on basis but the higher variable cost is definitely going to get grain moving quicker than previous. The high cost of storing beans is forcing beans into the market. One of the causes of the sluggish US domestic basis is not only can the farmer not afford to store beans neither can the commercial. There is not enough incentive in the market to carry beans. Generally farmers have the higher variable storage cost than the commercial. In a purely economic flow producers would liquidate before commercial grain handlers. Taking this as step forward what might the impact be to basis next fall. We need to keep this in mind as we plan for space needs into the various upcoming harvest seasons.

Here are couple more items on interest rates and the farm.

- Inputs supplies are enduring higher cost of carrying inventory. Fertilized is one of the bigger cash outlays in grain farming. Opportunity may be knocking. Be on the lookout for some sharp discounts as suppliers try to liquidate ahead of certain internally generated cut off points.

- Shrink is costing you more. It hurts significantly worse to lose a $15 soybean than an $8 per bushel soybean

- Interest as a production cost

- Assume I borrow $500/acre of corn on average and year round.

- My interest rate is 8%

- My interest cost /acre = $40/acre

- On farm inventory insurance is going up

- Do you know what it is costing per month?

- How are you reducing coverage as inventories ship?